GUIDE TO ACCESSING YOUR

RETIREMENT ACCOUNT

How

Can I Access My Retirement Plan Information?

The Retirement Plan Company, LLC

(“TRPC”) has designed two easy ways for you to access your retirement account

information. Both methods allow you

access to the most up-to-date account information 24 hours a day, 7 days

week. We pride ourselves on our

state-of-the-art technology, both for its availability and for its ability to

house your information in a secure and confidential

environment.

You

choose how to access your account data:

1)

Via the Internet

at www.TRPCWEB.com

2)

Via the Telephone

at 1-888-673-5440

If you have difficulty using either

method, please call our customer support line at 1-888-673-5440

from 7:00 a.m. CST

to 6:00 p.m. CST (Monday through Friday). If you are calling outside our

regular business hours, please leave a voice-mail message and a customer support

specialist will return your call by the close of the business day, or log into

our website at http://www.trpcweb.com/ and

click on the “on-line participant service center” link to send us an

email inquiry.

How

do I start?

Log

on to: http://www.trpcweb.com/

TRPC’s interactive web site allows

you to view your account information and process transactions online. In addition to accessing account

information, you have the ability to create account statements, view detailed

transaction information, transfer funds, rebalance your portfolio, and much

more. By logging on to http://www.trpcweb.com/ you have the tools

necessary to manage your retirement account.

First Time

Users:

The first time you login you will be

asked to provide a User Id and Password. These two fields have been set to our

system defaults:

User

Id: Social Security

Number (No dashes)

Password:

Last four digits of

your Social Security Number

IMPORTANT:

Upon

accessing your retirement account for the first time, you will be required to

choose a new User Id and password for security reasons.

This process is outlined in the

“Transactions/Change Requests” section of this brochure. It is very important that you change you

User Id and PIN.

NOTE:

Please access http://www.trpcweb.com/ with Netscape 6.0+

and Internet Explorer 6.0+.

While our web site should work with browsers from Netscape or Internet Explorer that are within this version range, there may be versions designed specifically for AOL or Macintosh which may encounter problems with some JavaScript used in this site. Problems experienced with these browsers should be considered bugs in these browsers. You may contact your browser distributor about the problem. AOL subscribers may opt to use Internet Explorer or Netscape directly instead of going through the AOL browser. New devices (such as wireless telephones, personal digital assistants, etc.), which are Internet accessible, may not have browsers capable of properly navigating this site.

Internet

Capabilities:

Below is a brief overview of the

options available through the TRPC Internet site.

Account

Information:

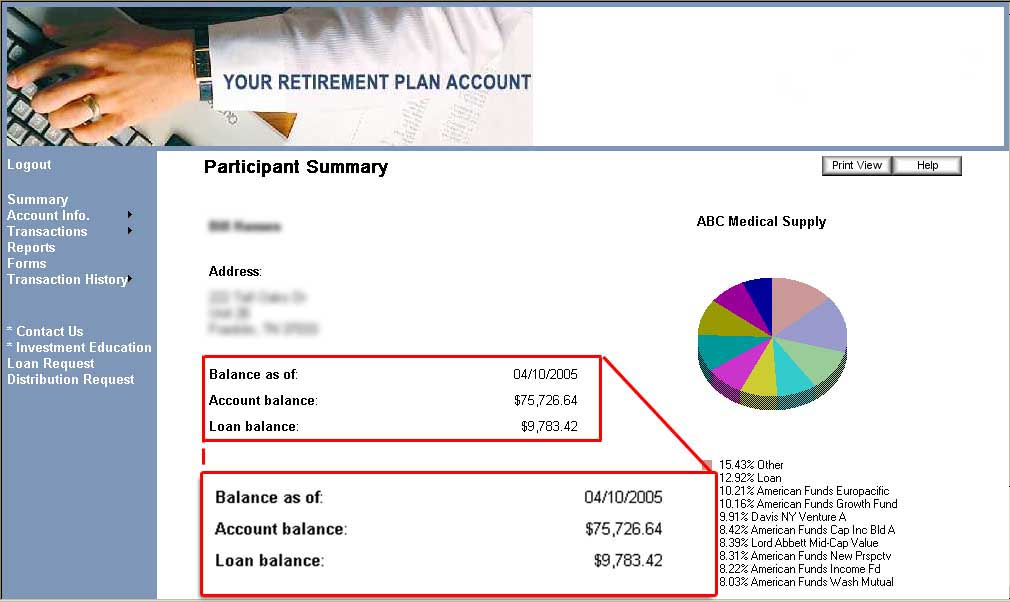

Summary: This is the first page you see after

you log in. It provides a snapshot

view of your retirement account. In

addition, it lists some basic demographic and payroll

information.

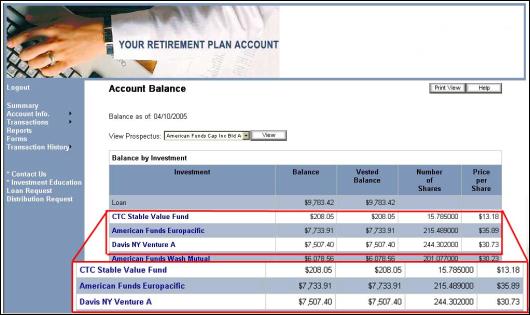

Account

Balance: This

page provides a list of

your balances by “Investment” and

“Source”. Click on any

Investment name to access a quick fund fact sheet. Click on a money source to view

the underlying investments that comprise that source’s account

balance.

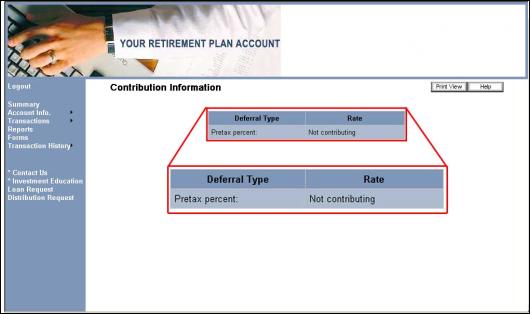

Contribution

Information: View current deferral amounts and/or

deferral rates (the amount deducted from your paycheck for retirement plan

contributions).

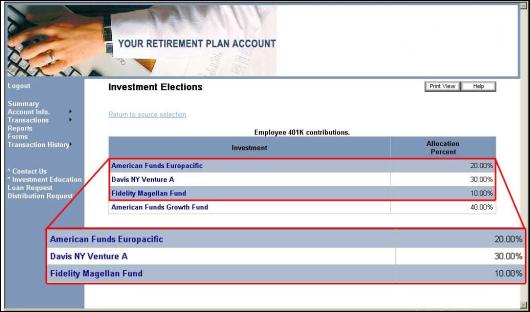

Investment

Elections: This page lists your current

investment elections. These

elections dictate where your FUTURE payroll contributions and loan repayments

will be invested.

Investment

Profiles: This page provides some or all of the

following information related to your investment alternatives: Risk Level (as defined by Morningstar),

Fund Family, Investment Ticker, Current Day’s Price, Fund Information

(hyper-link to fund family web site).

In addition, if you click on any investment you will be provided a quick

fund fact sheet (analysis provided by Morningstar). Also, if you click on “Performance

For All Available Funds” you will be provided with a quick overview of the

investment’s price history for all investment options offered by your

plan.

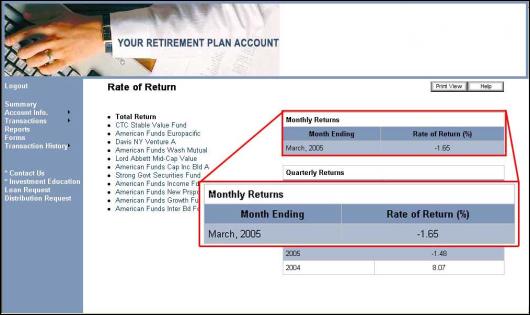

Rate

of Return: This page provides a time-weighted

personal rate of return for your account.

This rate of return reflects how your funds have performed over the

stated time periods. This return

includes the effect of both contributions and withdrawals that were made to your

account.

Transactions/Change

Requests:

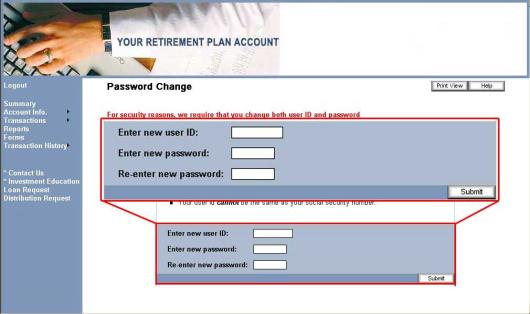

Password

Change: This page allows you to change your

User Id and Password. This is very

important. Please change both your

User Id and Password the first time you log on to http://www.trpcweb.com/.

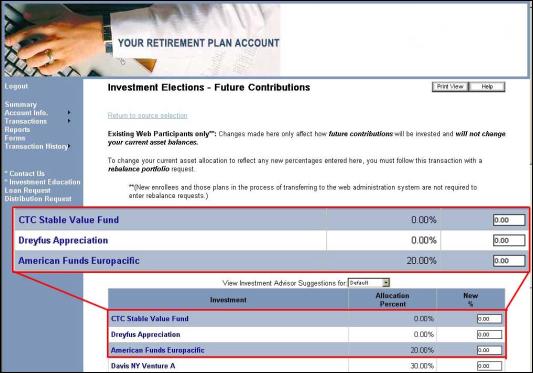

Investment

Elections: This page allows you to change where

all FUTURE payroll contributions and applicable loan payments will be

invested. This section may allow

you to change your investment elections for individual sources of money

(employee deferral, employer match, rollover) and/or there may be the option to

change investment elections for “All Sources”. When entering your new elections,

please make sure they equal 100 percent.

In addition, PLEASE NOTE this option WILL NOT realign your

existing account balance. If you

wish to allocate your current account balance in this same manner, use the

"Create a single rebalance transaction" option on the "Rebalance Portfolio" page

after choosing your investment elections.

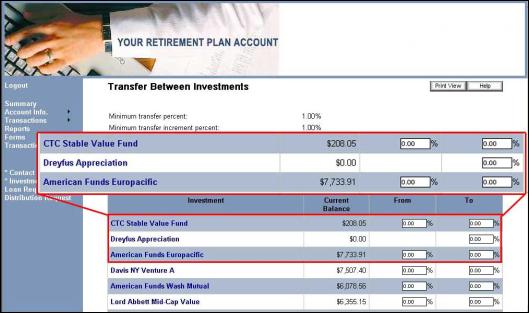

Transfer

Between Investments:

This

page allows you to transfer your current balance from one or more of your

existing investments into one or more new investment choices, without

affecting your entire portfolio.

Please make sure

that you have entered transfer percentages equal to 100 percent for the funds

that you are transferring INTO.

Important: This option will not change where

your future payroll contributions will be invested. To change the way that your future

payroll contributions are allocated, you must proceed to the “Investment

Elections” Page.

Rebalance Portfolio: This page has two options:

1) Create a single rebalance transaction, or

2) Create a recurring rebalance

transaction.

The

“Create single rebalance transaction” allows you to initiate a one-time

transaction that conforms your existing account balance to your current

investment elections.

The

“Create recurring rebalance transaction” allows you to enter a single

transaction that will automatically conform your account balance to your current

investment elections at the interval entered for the transaction. Currently you can set the interval for

monthly, every 3 months, twice a year, or once a year. In addition you can indicate the day of

the month (including last day of the month) that the rebalance should take

place.

Conform

to Target: This

page allows you to transfer your ENTIRE current account balance into new

investments of your choice, based on the percentages you enter in the "Target %"

column.

Important: This option will not change where

your future payroll contributions will be invested. To change the way that your future

payroll contributions are allocated, you must proceed to the “Investment

Elections Page.”

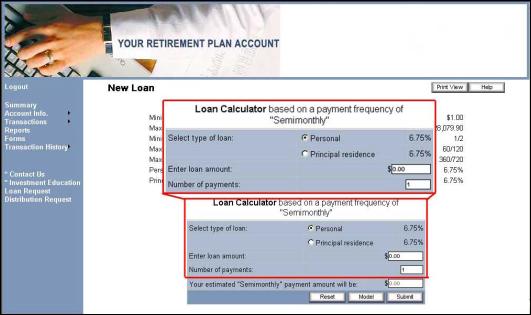

Loan

Modeling: You have the ability to model a new

personal or residential loan on this page. To request a new loan, please

click on the “Loan Request” link in the left navigation menu. This option may not be available for all

plans.

Withdrawals: This page allows you to hyper-link to

the “Distribution Status” page, which details the status of your distribution

request. This option is not available for all

plans.

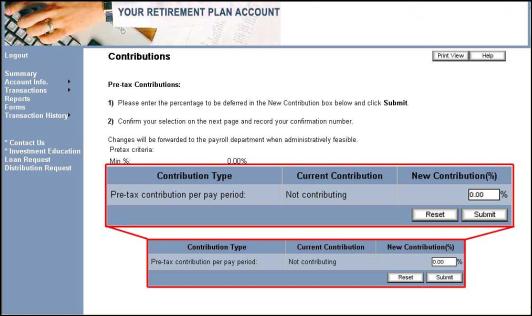

Contribution

Changes: View and change your current deferral

amounts and/or deferral rates (the amount deducted from your paycheck for

retirement plan contributions).

This option is not available for all plans.

Transaction

Reporting:

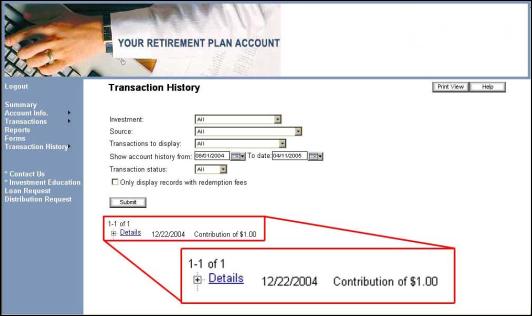

Transaction

History: This page

displays the financial transactions that have posted to your retirement account,

such as contributions, dividends and transfers. You can filter the data to search for a

specific type of transaction by selecting filtering options from the following

drop-down menus: Investment, Source, Transactions to Display, and Transaction

Status. You can also specify a

beginning and end date for your search.

Web/VRU

Requests: This

page displays requests that were entered through the website or the VRU. You can

filter the data to view by different criteria, including transaction type,

transaction status, and confirmation number. You can also enter a beginning date.

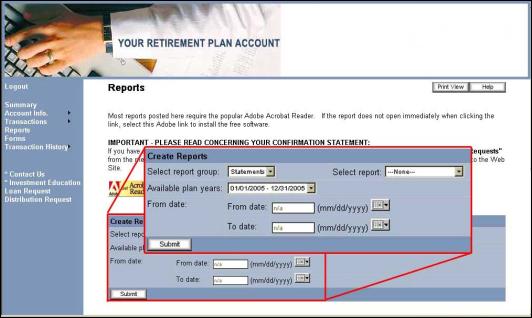

Reports: This page allows you to create an

on-line version of your Participant Statement for a period of time that you

designate. The only time constraint

is that the report interval must be within the same plan year. To create a statement,

select the

“Statements” option in the “Select

report group” drop-down menu, then choose the “Participant Certificate” option

in the “Select Report” drop-down menu.

Forms: This page allows you to download and

print beneficiary and rollover application forms. It is very important that you read the

forms’ instructions very carefully.

Failure to properly complete the form will extend the time it takes to

process your request.

TRPC Customer

Service

You can speak with a “live”

representative from 7:00 a.m. CST to 6:00 p.m. CST (Monday through

Friday). If you are calling outside our regular business hours, please

leave a voice-mail message and a customer support specialist will return your

call the next business day.

If you have Internet access, you can

select our "on-line participant service center" link on our login page,

or the "Contact Us" link in the left navigation menu and we will respond

within one business day.

Voice

Response Unit: 1-888-673-5440

TRPC's interactive Voice Response

Unit (VRU) allows you to listen to your account information and initiate

transactions 24 hours a day, 7 days a week. By dialing 1-888-673-5440

you have the tools

necessary to manage your retirement account.

We have provided a brief overview of

the options that are available on the Voice Response Unit (VRU). Because options may differ between

plans, it is imperative that you listen closely to the voice instructions. If you have any difficulty, please call

our customer support line at 1-888-673-5440.

Balance

Information: This option voices your account

balance as of the most recent valuation date. You may also request to hear your

account balance on a per fund basis, or by money source.

PIN

Change: This option allows you to change your

PIN number. Please note that

changing your PIN number for the Voice Response Unit (VRU) does not

automatically change your PIN for the Internet site. It is very important that the first time

you dial into the VRU you change your PIN Number.

Investment

Information: This option allows you to listen to

your investment elections. In addition, you can change your investment

elections. Please remember that

changing your investment elections only affects your FUTURE payroll

contributions. If you want to

change your existing account balance, your must access the “conform ending

balance” option.

Contribution

Information: This

option voices your current contribution (deferral) amount and/or deferral

percentage. It also allows you

to change

the amount or

percentage of your

payroll that will be deducted for contributions into your retirement

account. (Note: These

options may differ by plan.)

Loans:

Model a new loan,

request loan paperwork, or request a loan check. (Note: These

options vary by plan and eligibility.)

Transfer Between Investments: This option allows you to transfer your current balance from one of your existing investments into one or more new investment choices, without affecting your entire portfolio.

Conform

Ending Balance: This option allows you to rebalance

your existing balance according to your current investment elections, or

transfer

your entire current balance into new investments, based on the percentages you

enter for each fund.

Please note that this election will not effect your FUTURE payroll

contributions. If you wish to

affect your FUTURE contributions you must access the “Investment Information”

option.

Frequently Asked Questions

How

Do I access my Account?

Go to www.TRPCWEB.com to access The Retirement Plan Company Home Page. From here you are one click away from logging into your retirement account. Simply look to the top left-hand portion of the page. You will see a link titled, “Login to Your Retirement Account”. Click on this link and the next page will display the User Id and Password fields. If you have never accessed the site before please refer to the section in the brochure titled, “How Do I Start” to find out the default settings for the User Id and Password fields.

What

is the difference between an “Investment Transfer” and an “Investment

Election”?

Your investment elections tell us where your FUTURE

payroll contributions should be invested, whereas an investment transfer changes

your EXISTING account balance.

·

To

change the way that your FUTURE payroll contributions will be allocated:

Click

on the “Investment Elections” choice in the “Transactions” menu. Please remember that changing your

investment elections does not effect how your existing account balance is

invested.

·

To

change the way your EXISTING account balance is allocated, choose one of the

following options in the

“Transactions”

menu:

1) Investment

Transfer

2) Rebalance Your

Portfolio

3) Conform to

Target

Please

remember that by changing your existing account balance you are not affecting

how your future payroll contributions will be invested. To affect your future contributions you

must change your “Investment Elections”.

When

should I use the Transfer Between Investments

transaction?

The

Transfer Between Investments function should be used when you want to move money

from one fund to another fund, without affecting the other investments in your

account. Transferring between current investments will not change how your

FUTURE payroll contributions will be invested.

When

do I want to initiate a Rebalance Portfolio

Transaction?

This transaction is typically used in two instances. First, you have recently changed your investment elections (changed where your future contributions will be invested) and you now want to change your existing account balance to reflect your new investment elections. The second instance that this transaction is typically used involves the on-going management of your retirement account. Many Investment Advisors advocate rebalancing your portfolio at least once a year. The effect of this rebalancing is to bring your existing account balance back into conformity with your investment elections. This type of rebalancing transaction can be done by utilizing our “create recurring rebalance transaction”, which allows you to set a time interval that will automatically rebalance your account.

When

would I use the Conform to Target Transaction?

This transaction is typically used

when you desire to transfer your entire existing account balance into new

investment choices, and do NOT want to rebalance your existing funds in the same

manner that your future payroll contributions will be

allocated.

Why

do accounts become locked or disabled?

As a security measure, your account will become disabled if your entered your User Id/Password combination incorrectly three consecutive times.

How

can I remove the lock from my account?

If your account becomes locked you

may contact TRPC through two avenues:

1)

Go to

www.TRPCWEB.com and select the "on-line participant service center" link

and request a Password reset. This

will be done within one business day of your request.

2)

Call us at

1-888-673-5440

and speak with a

“live” representative from 7:00 a.m. CST to 6:00 p.m. CST (Monday through

Friday). If you are calling outside our regular business hours, please

leave a voice-mail message and a customer support specialist will return your

call the next business day.

How

can I request a Distribution Form?

TRPC has created a number of ways for

you to request a distribution form:

·

Click on

the “Distribution Request” link in the left navigation menu, fill in the

requested information and click on the "Submit" button to send your

request.

·

Click on the

"on-line participant service center" link on our login page, or the

"Contact Us" link in the left navigation menu and request the

distribution form be sent to you.

·

Call us at

1-888-673-5440

to request that a

distribution form be sent to you.

How

can I request a Loan?

TRPC has created a number of ways for

you to request a loan:

·

Click on the

“Loan Request” link in the left navigation menu, fill in the requested

information and click on the "Submit" button to send your request.

·

Click on the

"on-line participant service center" link on our login page, or the

"Contact Us" link in the left navigation menu and request the loan

information be sent to you.

·

Call us at

1-888-673-5440

to request that loan

information be sent to you.

Note: To model a loan and find out approximate

loan payment amounts, click on the “New Loan” option in the Transactions

menu.

Information

You Need to Know Prior To Entering a Transaction

Market

Value of you Account:

The value of

your account balance will change each business day to reflect the investment

market changes. The balances will

be valued as of the end of the previous business day, or the date prices were

most recently received. NOTE: For

dates when the New York Stock Exchange (NYSE) is closed, your balance will be

based on the previous day the NYSE was open. For plans valued less frequently than

daily, the value of your account balance will be as of the most recent valuation

cycle.

Transaction

Request Deadlines:

Because retirement plans have

different needs, TRPC utilizes a number of different trading platforms. Please contact your Human Resource

Department about your specific transaction deadline. Any transactions receive after the

stated trade deadline will be processed on the next business day on which the

NYSE is trading.

Internet

Security: TRPC diligently works to protect the

confidentiality of your account information. We have employed data encryption to

protect your information as it passes from the web server, your browser and the

secure firewall. NOTE: Since the Internet is an unregulated and

unpredictable environment, TRPC cannot guarantee the complete security of

account information. System use is

only for authorized personal use; state and federal laws make it a crime to gain

unauthorized access into computer systems.

Violators will be prosecuted.

System

Availability for Access to Account Information:

Periodically our systems will require

maintenance. During the maintenance

period the system may become unavailable.

TRPC will endeavor to perform these maintenance periods at a time that

will cause the least disruption possible.

Beyond scheduled maintenance, TRPC recognizes that systems can sometimes

be interrupted due to circumstances beyond our control. Due to this TRPC cannot guarantee that

access to your account information will be free of delay or

interruption.